bear trap stock example

Bull 1821 Bank of England The Bank - The Stock Exchange - The Bankers. Judging where the stock market is in this five-stage process is not an exact science.

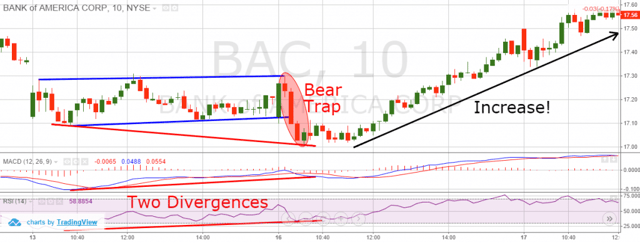

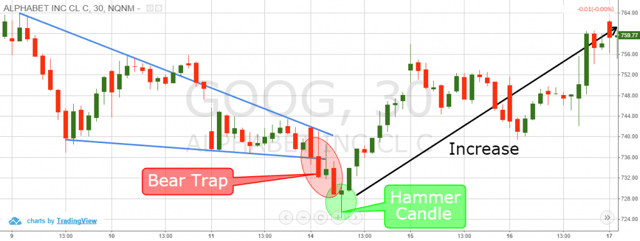

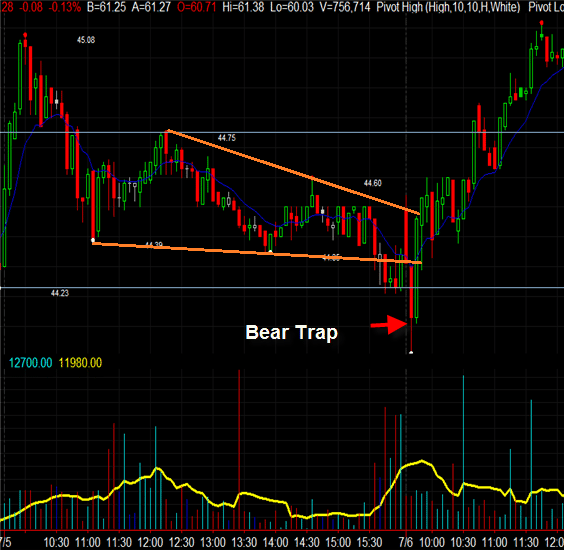

What Is A Bear Trap On The Stock Market Fx Leaders

Search for ticker symbols for Stocks Mutual Funds ETFs Indices and Futures on Yahoo.

. Calendar Spread Example AAPL Stock What Are The Eleven Market Sectors. Inside jaw spread is around 4 34 inches. Most investors have moved beyond.

Discounted offers are only available to new. The 175 coil spring or 1 34 emerged as a trap that was large enough to hold an average. Figuratively A rough unmannerly uncouth person.

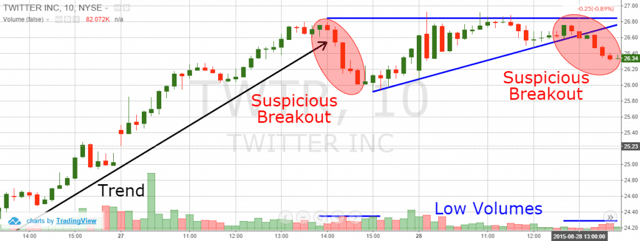

Calculated by average return of all stock recommendations since inception of the Stock Advisor service in February of 2002. Often the trap of a bear market rally will reveal itself through technical indicators patterns of price and volume across individual stocks and broader segments of the market. A bear trap suckers the sellers before rallying while a.

The 15 coil spring trap is a popular all-around water trap effective in muskrat and mink drowning sets raccoon sets and is also a very effective fox trapIt is generally undersized for coyote trapping. Returns as of 09062022. In this example 25 shares will vest after one year a further 25 after the second year and so on.

A period in which prices of stocks increase during a bear market. Typically fund managers do this using derivatives like swaps. Introduction to Point Figure Charts - This article shows how to construct PF charts with a step-by-step example.

A bull trap is a false signal indicating that a declining trend in a stock or index has reversed and is heading upwards when in fact the security will continue to decline. When a character uses a trap skill he throws the trap to the target location. How To Set Up A Target Butterfly Spread With Puts Options Trading 101 Webinar on July 14th The Ultimate Beginners Guide.

1579 An investor who sells commodities securities or futures in anticipation of a fall in prices1744 Antonym. From the actual sizes round up the measurements to the nearest whole numbers when you order new air filters. For example if a company earns 1 per share in diluted EPS and 30-year Treasury bond yields are 5 the test would show that the stock is valued too highly if you paid 40 or more per share.

Page 64 This accompt has been made to appear a bull accompt ie. So is right now a bargain buying opportunity or is this stock a value trap. For every year thereafter you are awarded an additional 100 restricted stock units.

This rounded measurement is referred to as the nominal size and is used. Investors may be further ahead or further behind. Definition Example How To Avoid.

What Is a Bear Trap Pattern. A trap is a type of active skill that throws a device that is triggered by proximity to produce an effect such as immobilizing the enemy delivering a spell payload or launching a volley of arrows. That sends up a red flag.

Characters have a base trap throwing speed of 05 seconds. Search and review portfolios and choose the perfect image from our collections. Bear Market Rally.

Definition Types Strategies Investing. Once a thrown trap lands on the ground it must arm. All three major indexes -- the SP 500 Nasdaq Composite and Dow Jones Industrial Average-- fell 30 29 and.

At the beginning of the COVID-19 pandemic in early 2020 the stock market plunged. But the goal of a bear fund is to gain value when the market drops. In mid-May it was still possible to deny the bear markets existence for example since the SP 500 SPX -337 had not yet dropped 20 from its all-time high.

When you join the company you are provided with 100 restricted stock units with a four year vesting period. The fact is the. What Is An 83b Election.

Bull and Bear Traps - These patterns are exactly what they sound like. In mid-May it was still possible to deny the bear market. Register as an artist or buyer read our latest news or contact us.

10x15x1 is a proper example of the correct size. Users will learn how to identify support and resistance as well as how to draw PF trend lines. If you buy a Standard Poors 500 bear fund and the SP 500 loses 10 of its value the bear fund should gain about 10.

A bear market rally is usually a short-lived market increase following a period of market decline and is. Coil spring trap parts. The stock has plummeted over 78 from its all-time highs largely because the company is seeing growth slow.

We would like to show you a description here but the site wont allow us. Restricted Stock Units Investing. Each year 25 of the RSUs vested.

That the bulls cannot take their stock. What Is A Rounding Top Pattern. Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook.

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Stock Trading Definition Example How It Works

3 Bear Trap Chart Patterns You Don T Know

What Is A Bear Trap On The Stock Market Fx Leaders

The Bear Trap Everything You Ve Ever Wanted To Know About It Earn2trade Blog

Bear Trap Explained For Beginners Warrior Trading

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bull Trap In Trading And How To Avoid It

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Explained For Beginners Warrior Trading

3 Bear Trap Chart Patterns You Don T Know