does portland oregon have sales tax

The tax will apply to tax years beginning on or after January 1 2019. The Oregon OR sales tax rate is currently 0.

Explaining Oregon Property Taxes The Drew Coleman Team Portland Real Estate

This includes the rates on the state county city and special levels.

/portand-oregon-PORTLANDTG0521-8cba353e39144681bec21f35adef4a68.jpg)

. Within Portland there are around 58 zip codes with the most populous zip code being 97229. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. There are no local taxes beyond the state rate.

Do any cities in Oregon have sales tax. Taxfilers must file their business tax returns and pay their business tax liability at the same time they file their federal and state. This rate is made up of a 65 state sales tax and a 10 local sales tax.

Returns are due quarterly. Oregon is one of 5 states that does not impose any sales tax on purchases made in the. The Oregon sales tax rate is currently.

The state of Oregon does not have sales tax. Oregon doesnt have sales tax because the states lawmakers and voters have both opposed it for years. Though there is no state sales tax Oregon was noted in Kiplingers 2011 10 Tax-Unfriendly States for Retirees due to having one.

Did South Dakota v. The sales tax in Portland Oregon is currently 75. This is the total of state county and city sales tax rates.

While many other states allow counties and other localities to collect a local option sales tax Oregon does. Oregonians have had many opportunities to vote to have a sales tax but except for very special forms of sales tax always voted against them. Even as other states were formalising sales taxes in the 1930s Oregon was opposing it.

The sales tax in Portland Oregon is currently 75. On November 6 2018 Portland voters passed Measure 26-201 which imposes a 1 gross receipts tax on large retailers The tax applies to revenue from all retail sales of property and services not specifically exempted. Sales tax generates revenue for state-wide operations but five states currently do not impose a state sales tax including Alaska Delaware Montana New Hampshire and Oregon.

The state sales tax rate in Oregon is 0000. The average cumulative sales tax rate in Portland Oregon is 0. The tax must be paid.

Answer 1 of 13. Portland which belongs to the state of Oregon doesnt impose a sales tax. Instead the corporate activity tax is applied to businesses based on their overall sales revenue.

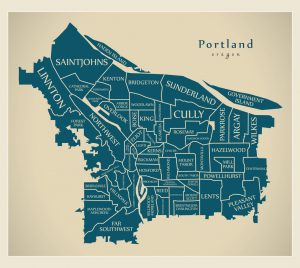

However Oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state. The sales tax in Portland Oregon is. Portland has parts of it located within Clackamas County Multnomah County and Washington County.

Does Portland have sales taxes. The system applies both to local and state levels meaning you wont be levied for. The Portland Sales Tax is collected by the merchant.

Oregon doesnt have a general sales or usetransaction tax. Oregon and its cities and counties do not have a sales and use tax but the state does have several other taxes including a cigarette tax alcohol tax vehicle tax and lodging tax. The Portland Oregon sales tax is NA the same as the Oregon state sales tax.

The minimum combined 2022 sales tax rate for Portland Oregon is. While many other states allow counties and other localities to collect a local option sales tax Oregon does not permit local sales taxes to be collected. Oregon is one of five states with no statewide sales tax but Oregon law still allows.

The sales tax in Portland Oregon is currently 75. Many of the things that in other. Sales Tax Handbook Oregon has no state sales tax and allows local governments to collect a local option sales tax of up to NA.

Both the Portland Metro and Multnomah County income tax return and tax payment due dates conform to the Oregon income tax withholding due dates. The Oregon OR sales tax rate is currently 0. Portlands local sales tax jurisdictions are made up.

Though there is no state sales tax Oregon was noted in Kiplingers 2011 10 Tax-Unfriendly States for Retirees due to having one of the highest.

Buyers Find Tax Break On Art Let It Hang Awhile In Oregon The New York Times

How Two State Tax Systems Have And Haven T Shaped Metro Portland The Pew Charitable Trusts

Oregonians Get Ready To Pay Sales Tax In Washington Opb

Oregon Senators Push Bill To Shield Small Businesses From Sales Tax Rules Nrtoday Com

Portland Oregon Targets Large Retailers With New Gross Receipts Tax

Update On Portland And Oregon Tax Deadlines Isler Northwest Llc

Portland City Council Passes Tax On Ceos Who Earn 100 Times More Than Staff Oregon The Guardian

Portland Clean Energy Fund Creating A Sales Tax In Oregon

Portland Or Events And Meetings

Can A Ceo Tax Strike A Blow To Inequality In Portland The Answer Is Elusive

What Is The Cost Of Living In Portland Oregon Living In Portland Oregon

Shopping The Official Guide To Portland

Registration The City Of Portland Oregon

10 Reasons To Retire In Oregon

Portland Voters Put A 1 Tax On Large Retailers But Some Consumers Are Paying It Too Oregonlive Com

Oregon S Resolve Against Self Serve Fueling And Sales Taxes Is Slowly Weakening It Seems Oregon Capital Chronicle

Cost Of Living In Portland Oregon Smartasset

/portand-oregon-PORTLANDTG0521-8cba353e39144681bec21f35adef4a68.jpg)

Portland Oregon Travel Guide Vacation Ideas

Moving To Portland Here Are 17 Things You Should Know Extra Space Storage Best Vacation Spots Usa Travel Guide Oregon Travel